Best Accounting Software for Small Business in 2025

Are you still managing the financial side of your business using spreadsheets? It’s time to evolve. Small businesses today require strong accounting software to remain competitively compliant. The right accounting software won’t merely help you track your expenses and income; it will change the way that you manage your whole business. In the modern world, accounting solutions can bring the measure of automation, tax-compliant structure, and financial visibility that growing companies desire.

Automation eliminates everyday repetitive tasks, and it provides access to real-time financial data. There are too many accounting software solutions out there- will you choose the right one? In this guide, be reassured by the top solutions for small businesses in 2025.

Why Small Business Owners Should Consider Accounting Software

Managing your own bookkeeping is inefficient and may encourage human error that can be expensive. While the modern accounting software does not eliminate error, it does mitigate the risk while providing key features that spreadsheets cannot.

- Saving Time and Improving Accuracy: Relieving you of calculations, automated data entry, and analytical functions minimizes errors that can cost a business time or money. Life is too short to spend hours putting together manual calculations with Excel when it could be spent building your business.

- Tracking finances in Real-Time: It is now possible to gain insight into your finances, including cash flow, profit margins, and general financial well-being, with just a glance. Real-time dashboards allow you to make quick decisions about purchasing inventory or that new opportunity.

- Automated Calculations & GST-Ready Reports: An accounting application automation of your tax calculations, with GST-ready reporting, means you are always compliant with your tax responsibilities in India.

- Growth Potential Expansion: As your business grows, your accounting software can also grow. Adding new users, new locations, or add-on feature capabilities does not require a different software provider or the loss of historical data.

Key Things to Look Out For

When assessing suitable accounting software, you should take into account these features that specifically affect how you operate your business:

- Cloud-Based: Access your financial information from anywhere and at any time. Cloud-based software also allows different members of your team to collaborate productively, whether they are working from the office or their home.

- Invoicing & Billing: Create professional invoices, automate reminders for payment, and integrate with many payment gateways will help get your revenue collection process more efficient.

- Expense Tracking: Automatically categorize and track what your business is spending. Additionally, use mobile apps to capture a receipt as you get it. This will help ensure you don’t miss any deductible expenses.

- Payroll prepping: Processing payroll that accounts for tax compliance is hard work for HR. Accounting software transfers the payroll burden to your payroll provider from your HR department. All the HR department has to do is pay the employees.

- Multi-user access: Allow your employees, bookkeepers, and accountants access to the information that you choose based on whatever permissions you set for them.

- Security & Backups: Whenever you entrust sensitive financial information to cloud software, bank security protocols should be of the utmost importance. Automatic backups of your business data will convert your nightmares about lost data due to a cyber threat into a more positive moment for your business.

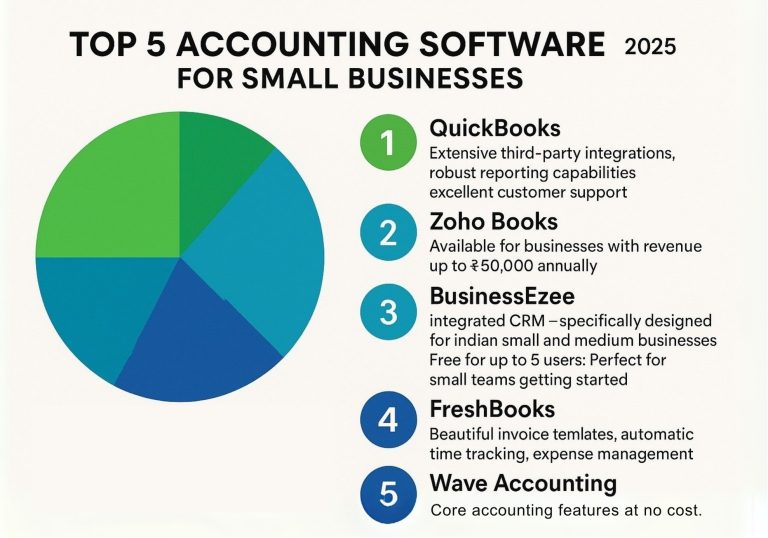

Top 5 Accounting Software for Small Businesses (2025)

1. QuickBooks

QuickBooks is the most widely used accounting software for small businesses globally. Its powerful features and intuitive interface are advantageous to companies of all sizes.

Pros: Excellent third-party integration capabilities, a lot of reporting functionality, good customer service, and an industry-specific version for small businesses as well.

Cons: Pricing is higher than competitive software, it may seem overwhelming for micro-businesses, and there is a limitation to personalizing the software.

Price Point: Basic packages start from about ₹1,500/month.

2. Zoho Books

Best for: Indian businesses (GST-ready)

Zoho Books presents exceptional value with its range of strong GST compliance features tailored specifically for Indian businesses.

Highlights: GST filing, multi-currency payments, project management integration, and a great mobile app.

Free Plan: Free for businesses with annual revenue up to ₹50,000.

3. BusinessEzee

Best for: End-to-end business management with CRM + Accounting

Unique to BusinessEzee is the integration of accounting functions with full business management functions. The platform is jokingly called an all-in-one software with an intuitive accounting dashboard, billing that’s GST-ready, expense tracking, and an integrated CRM-all specifically tailored for small and medium Indian enterprises.

Why Choose BusinessEzee:

- Free for up to 5 users: Perfect for small teams getting started

- The system combines sales and customer management in one: you can manage the entire customer life cycle, from lead to payment.

- Great for a growing studio-type of business: Project management, Invoicing, and Client management all in one platform.

The approach that the platform takes with its broader approach towards management can also be seen to be a rather unique approach, and with regard to companies that have a service aspect, it would be extremely crucial for them in their day-to-day tasks.

4. FreshBooks

Best for: Freelancers and small agencies

FreshBooks is known for its simplicity and client management; hence, it is a great product for service-based companies.

Key Features: Beautilful invoicing templates, automatic time tracking, expense management, and seamless integration with payment gateways.

Ideal Users: Consultants, creative agencies, and professional service providers who require accounting solution that can be targeted at their clients.

5. Wave Accounting

Best for: Free forever plan

Wave software provides free accounting software that is surprisingly complete for small firms.

Strengths: Core accounting features for free, simple interface, good customer support.

Limitations: Suitable for teams of less than 10 members, very few advanced features, earning is mostly on the basis of processing fees for payments.

How to Choose the Right Accounting Software for Your Business

Selecting the perfect accounting software depends on several crucial factors:

Business Size and Complexity

Larger businesses with multiple departments need more robust features

Budget Considerations

monthly subscription costs but also implementation, training, and add-on expenses.

Industry-Specific Needs

Retail businesses need inventory management, while service companies time.

Support and Training

Ensure your chosen solution offers adequate customer support and training resources for smooth implementation.

Final Thoughts

The right accounting software transforms your business operations from reactive to proactive. QuickBooks offers the most comprehensive solution for growing businesses, while Zoho Books provides excellent value for Indian companies. BusinessEzee combines accounting with CRM for holistic business management, FreshBooks serves freelancers perfectly, and Wave delivers essential features for free.

Before committing to any solution, take advantage of free trials to test functionality with your actual business data. The best accounting software is the one that fits your specific workflow, budget, and growth plans. Start with a free trial today and experience the difference professional accounting software can make for your business success.

Get started with Businessezee now and take the first step toward sustainable business growth.